How do you spend Bitcoin? Centra Tech’s mission was to create a legitimate debit card to use to spend Bitcoin—a digital form of money. Investors who had mined millions of dollars would have access to their cryptocurrency.

But first, you need cryptocurrency. Then, you would need a crypto wallet. With crypto payment processors, you can shop with companies accepting Bitcoin and paying from your wallet. Bitcoin cards allow you to shop anywhere Mastercard and Visa are accepted.

Table of Contents

- Centra Tech’s Key Player’s Background and History

- Masterminds Behind Centra Tech’s Bitcoin Scheme

- The Genesis of Centra Tech

- Centra Tech’s Initial Coin Offering

- Warning Signals

- Celebrity Endorsements

- The New York Times Investigation

- Centra Tech’s Lawyer

- Centra Tech’s Big Ambitions

- South Korea’s Investment

- Centra Tech’s Initial CEO

- SEC’s Investigation

- Founders of Centra Tech Indicted

- Charges Against Centra Tech’s Executives

- Government Recovers Digital Funds Worth More than $60 Million

- Crypto Scams

- Crypto Financial Regulators

- U. S. Judge: Centra Tech Tokens Were Securities

- Class Action Lawsuit

- Using Bitcoin Cryptocurrency

- Related Information on Bitcoin Cryptocurrency

Centra Tech’s Key Player’s Background and History

Raymond Trapani, from Atlantic Beach, New York, and Sohrab “Sam” Sharma, from Florida, loved money and luxury cars. From a young age, Trapani aspired to be a millionaire. When Oxy pills were flooding the streets, Trapani and friends were making $5,000/day using a stolen prescription pad to write illegal prescriptions. When apprehended by police, Trapani reportedly sold out his friends.

Trapani moved to Miami, Florida, and co-founded Miami Exotics, a luxury car rental business, where he met Sharma. While they disliked each other from childhood, Trapani believed Sharma could be a helpful business partner. They were both charismatic and had different abilities to offer. However, they needed to raise $500,000. Ray’s grandparents visited Miami to meet and listen to the business idea. Trapani’s grandfather agreed to sign a $250K loan for Miami Exotics, using his house as collateral.

Miami Exotics was earning $60,000 a month in profits; however, they were spending too much money on their lavish lifestyle—jewelry, nightlife, shopping, vacations, luxury hotels, gambling—money was eeking out. Miami Exotics was taking on more debt.

| $ 430.00 |

| Swarovski Octea Lux Chrono Watch, Swiss Made, Leather Strap, Blue, Stainless Steel | |

According to Bert, a third partner, Sharma, robbed the company. Something was wrong. A large number of checks were being written. Trapani was about to fire Sharma due to the failure of the venture.

In a desperate attempt to save the company and cover the losses he accumulated from his family’s investment, Trapani took $100,000 to a casino and ended up losing it all. Afterward, he attempted suicide by overdosing on Xanax pills.

Masterminds Behind Centra Tech’s Bitcoin Scheme

Sharma now wanted to talk to Trapani about cryptocurrency. Sharma introduced Trapani to Bitcoin as a way to gain wealth. They subsequently kicked Bert out of the company and co-founded Centra Tech.

Trapani and Sharma part ways with Miami Exotics and start a business that would be known as Centra Tech, Inc. Sharma would initially be the CEO. They would create a debit card for investors to spend their Bitcoin currency.

The Genesis of Centra Tech

The issue was how to spend Bitcoin with Centra. Two freelance developers were hired. Sharma did a lot of research. They copied the idea and documentation from TenX, another ICO, and replaced their name with Centra. With the help of developers, they had an official-looking website, a whitepaper, and a Slack channel ready. Centra Tech was a start-up company in the digital and online world of cryptocurrency.

According to Sharma, Centra Tech’s new CEO, an older man allegedly named Michael Edwards, was a seed investor. A mutual friend, Robert Farkas, was the CFO, although he had no background in finance or competence.

“I see us taking over as being the No. 1 company that people will use to use their crypto assets,” Mr. Sharma said, using an industry term for virtual currencies. “Once our proof of concept goes from beta to live, I think that we are going to take market dominance in the full aspect.”

The first token sale was initiated on July 30, 2017. The ICO went live and began slowly raising money.

An initial coin offering (ICO) is an unregulated fundraising technique with a dodgy reputation used by blockchain companies where cryptocurrencies like Bitcoin and Ethereum are used to purchase “tokens” from a start-up. If the company takes off, it’ll theoretically be worth something.

Centra Tech’s founders had promised cards. They tried to ship the crypto debit cards by Christmas in 2017. Farkas said, “We literally stayed up all night every night.”

Sharma also went after high-profile celebrities to help promote its operation. Immediately, millions of dollars were coming in. They raised $2 million working on a laptop computer out of a small bedroom. Afterward, they obtained an upscale office, hired employees, and more tech developers—with new technology, it was touted as the future of finance. They thought the company was fully legit.

This site has an affiliate marketing relationship with advertisements. I may receive a small referral fee or commission if you sign up for services or purchase a product. This allows me to continue to curate content.

With the marketing endorsements that Sharma pitched, money flowed in at approximately $500,000 daily. Video commercials showed celebrities using the card, and more investors were interested.

Centra Tech took off only because of its founders’ unsubstantiated claims. CentraTech was headquartered in Miami Beach, Florida. It was offering Blockchain products—A crypto debit card, a Wallet to store digital assets, and a prepaid card to spend the digital assets.

One investor, Jacob Rensel, believed Centra Tech had backing from Bancorp and Visa based on the website.

However, Centra Tech began raising money without going through any standard background checks; no one verified the company’s credentials with the credit card networks or other relevant authorities.

They claimed to offer cryptocurrency-related financial products, including a purported debit card, the “Centra Card,” supposedly allowing users to spend various types of cryptocurrency to make purchases at any establishment that accepts Visa or Mastercard payment cards. In July 2017, they began soliciting investors to purchase unregistered securities through a so-called initial coin offering in the form of digital tokens issued by Centra Tech.

As part of their effort, Sharma, Trapani, and Farkas, in oral and written offering materials that were disseminated via the internet, represented:

(a) Centra Tech had an experienced executive team with impressive credentials, including a purported CEO named “Michael Edwards” with more than 20 years of banking industry experience and a master’s degree in business administration from Harvard University;

(b) Centra Tech had formed partnerships with Bancorp, Visa, and Mastercard to issue Centra Cards licensed by Visa or Mastercard and

(c) Centra Tech had money transmitter and other licenses in 38 states, among other claims.

Based in part on these claims, victims provided millions of dollars’ worth of digital funds in investments to purchase Centra Tech tokens.

Centra Tech’s Initial Coin Offering

Press Release July 23, 2017: CentraTech Announced Initial Coin Offering (ICO)—Launching “Centra Card)

Ever since Bitcoin entered the financial world, Cryptocurrencies have grown at an astounding rate. In fact, market capitalization reached a new high of $93 Billion as of July 23, 2017. This was an increase of 1,263% over February 19, 2016. The problem becomes a methodology to integrate all of these blockchain currencies into a usable currency.

Centra Tech, Inc. has a brilliant solution, the world’s first Debit Card that is designed for use with compatibility on 8+ major cryptocurrencies blockchain assets. Their ICO is truly a ground floor opportunity to be part of a global solution to the blockchain currency dilemma that offers a comprehensive rewards program for both token and card holders while giving the ability to spend your cryptocurrency in real time with no fees. The Centra Debit Card enables users to make purchases using their blockchain currency of choice right through the Centra Wallet App. The Centra Card works anywhere that accepts Visa or MasterCard. How people shop and spend will never be the same.

The Centra Wallet App makes it easy for people to register for the Centra Debit Card, store their cryptocurrency assets, as well as control its functions, such as turning on or off the card without the usual hassle involved with contacting the issuing banks, etc. Users will be able to send money in 5+ currencies to over 100+ countries without being charged fees. The end user experience is enhanced by eliminating the costs associated with interbank exchange rate fluctuations and excessive fees. All assets stored on Centra Wallets are safe, secure and insured.

Centra’s also launching cBay which is the world’s first Amazon type of marketplace created especially for cryptocurrency acceptance. There will be over 100,000 items on the cBay marketplace with more to come. Users can choose from electronics, clothing items, household goods and more with worldwide shipping. This Cryptocurrency Marketplace will allow vendors to list their products for sale on the platform. Their Centra Wallet stores all blockchain asset cryptocurrencies, including: Bitcoin, Ethereum, Litecoin, ERC20 Tokens, Ripple, Zcash, Dash, Monero and more to come.

Centra’s mission to support a market and debit card also needed a way to instantly calculate exchange rates between the different cryptocurrencies in real time. Centra’s Currency Conversion Engine (CCE) quickly makes their blockchain assets available to the fiat that they are going to use for all supported Cryptocurrencies to give the user the ability to spend their assets anywhere in the world that accepts Visa and/or MasterCard.

Centra Tech Launching “Centra Card & Wallet”—The World’s First Multi-Blockchain Cryptocurrency Debit Card & Smart Insured Wallet (PR NewsWire, August 1, 2017)

Centra is a Crypto debit card for Bitcoin, Ethereum, Litecoin & more. The Centra Debit Card enables users to spend their cryptocurrency in real time with a 0% exchange, spend, & withdraw fees generally charged by other companies and has a secure, insured, & safe Smart Wallet.

Centra’s Initial Coin Offering (ICO) will begin on August 5, 2017, and ends on October 5, 2017. Their website contains comprehensive information about this offering.

| $ 2,386.45 $ 4,339.00 |

| Lenovo ThinkPad T14s Gen 2 Intel (14”) – Storm Grey | |

Warning Signals

ICO Review—Centra—Multi-Blockchain Debit Card or Red Flags (Crypt Bytes Tech, September 19, 2017)

In or about October 2017, at the end of Centra Tech’s ICO, the digital funds raised from victims were worth more than $25 million. Due to appreciation in the value of those digital funds raised from victims, those digital funds were worth more than $60 million.

However, the representations that SHARMA, TRAPANI, and FARKAS made to help secure these investments were false. In fact, the purported CEO “Michael Edwards” and another supposed Centra Tech executive team members were fictitious people who were fabricated to dupe investors.

Where was CEO Michael Edwards? People on Slack were demanding to interact with CEO Michael Edwards. More journalists and YouTubers published investigations. Centra offered money to take down a critical YouTube video, which was immediately re-broadcast into Centra’s Slack forum.

The team realized they had to cover their tracks and eliminate the CEO. They would claim he died in a car accident. Concerning Centra Tech’s purported CEO “Michael Edwards,” SHARMA text-messaged TRAPANI on or about July 29, 2017, that they “Need to find someone who looks like Michael,” “Team photos,” “He’s real lol,” “Everyone real,” “Except Jessica,” “And Mike.” Similarly, SHARMA later wrote during that same exchange: “Gonna kill both Ceo and her,” “Gonna say they were married and got into an accident.”

SHARMA, TRAPANI, and FARKAS were well aware of the falsity of such claims. For example, with respect to Centra Tech’s purported partnerships with Bancorp, Visa, and Mastercard, SHARMA engaged in a cellphone text message conversation with TRAPANI on or about July 31, 2017, in which they discussed Centra Tech’s lack of actual partnerships with banks or credit card companies.

During that exchange, SHARMA wrote: “Should write down a list of places to call tomorrow,” “For the conbranded [sic] card.” Later in the exchange, SHARMA wrote: “Gotta get it going on the banks today plz.” SHARMA also subsequently wrote: “We just need to get s [sic] banking license,” “Need our direct agreement with visa,” “Or MasterCard,” “That’s the move,” “Cut out the middle man,” “I wish we just knew someone.”

Regarding Centra Tech’s purported money transmitter and other licenses in 38 states, SHARMA had a text message conversation with TRAPANI and FARKAS on or about August 30, 2017, about applying for state licenses that Centra Tech had previously represented it already held in 38 states. For example, SHARMA wrote in one message on or about August 30, 2017, to TRAPANI and FARKAS: “Gotta apply for all licenses,” “Should I even say this.”

Celebrity Endorsements

The investors started to see no returns on their investments. These investors were people all over the world who loved Bitcoin. Eventually, despite having some celebrity endorsements, word spread that Centra Tech was indeed a fraud. Centra’s ICO was the subject of an in-depth article by The New York Times in late October that focused on celebrity endorsements of coin offerings.

How Floyd Mayweather Helped Two Young Guys From Miami Get Rich (Nathaniel Popper, The New York Times, October 27, 2017).

Farkas had been interviewed prior to the article but didn’t ask relevant questions or know what would be contained in the article.

Several days after the article ran, the Securities and Exchange Commission issued a public statement on celebrities’ “potentially unlawful” practices touting ICOs, saying such endorsements may violate the law if compensation agreements are not publicly disclosed.

After reading the article, Investor Jacob Rensel wrote a letter to his lawyer and sold his investment at a considerable loss. He gave information he had gathered to the SEC regarding Centra Tech and its relationship with banks and credit cards.

The New York Times Investigation

New York Times journalist Nathaniel Popper had caught wind of the organization since he covered a lot of crypto stories for the newspaper.

He reached out to Trapani and his team many times and was met with unclear answers to his questions. Popper’s research into Centra revealed that its executives falsified their LinkedIn accounts with non-existent degrees from Harvard University and executive positions at Wells Fargo. Instagram accounts linked to Miami Exotics. However, Popper sent a photography crew to Miami to get photos of the team and the offices.

From there, he got in contact with companies like Visa and many other legit financial organizations that Centra Tech said they were affiliated with on their website. Popper learned that they knew nothing of Centra Tech. Popper told Trapani and Sharma about that.

THE HEAT WAS ON. Soon after, cease-and-desist letters were sent to Centra Tech. The team reached out to a lawyer, who they had found in a Google search. It was the law firm of Pope and Dunn. Mr. Eric Pope advised Centra Tech to remove the affiliates and logos from its website.

After The New York Times reached out to Visa, Centra took all the mentions of Visa off its website. In an interview, Mr. Sharma said that the company had shifted its strategy and was planning to run its cards on the Mastercard network in partnership with a Canadian financial institution. He said this would not require approval from Mastercard because the Canadian institution would issue the cards.

But a Mastercard spokesman, Brian Gendron, disagreed. “Centra would need approval from Mastercard for something like that, and we are not aware of any approval that has been sought or achieved,” Mr. Gendron said.

Centra Tech’s Lawyer

Centra executives hired an in-house counsel to deal with the 500-page subpoena from the SEC. However, no law license was found for Eric Pope. An investigation found that Eric Pope was actually John Lambert, a college student. This guy was a fraudster. Everything was a lie. The scammers had been scammed. They had received legal advice over the phone from a college kid pretending to be a lawyer.

Centra Tech Scam is the Posterchild for the ICO Boom (Mark Hunter, FullyCrypto)

Centra Tech’s Big Ambitions

Without any limitations except their imagination, the three co-founders made all sorts of promises in a whitepaper. They promised to ‘bank the unbanked’ by offering a Centra wallet and card and a patent-pending ‘currency clearance engine’ to enable quick conversion of cryptocurrencies. Anyone using their card could spend money from their wallet anywhere Mastercard was accepted.

Centra Tech also offered a Centra Tool Kit, designed to “create the next level of integration and scaling of our services to a worldwide audience,” offering any exchange the chance to create their own branded debit cards and more.

One investor noticed changes to Centra Tech’s website. There was a new CEO. After researching more, he found that Trapani’s grandfather was allegedly the new CEO. He started sounding the alarm. He created a YouTube video discussing potential fraud. He was accused of spreading FUD—fear, uncertainty, doubt.

South Korea’s Investment

Bitsset Corp., in Seoul, Korea, contacted Centra Tech with a business proposition. They offered a generous sum of $5 million USD. They wanted to help them grow in the Asian market. They would have to go to Korea to show proof of concept. Sharma agreed to travel alone to Korea to make the presentation. Now, they needed an app. Tech developers began creating a prototype of a fake app. During the filmed presentation, Sharma addressed the false accusations. Sharma attempted to show how the app worked, but the transaction failed. Nevertheless, they still believed the company was a good investment and agreed to invest another $15 million. The video was edited to make it look like it worked.

In other countries, Bitcoin can also be used for online games—European Blackjack, slot machines, and other specialty games. ONLINE GAMES: Is Today Your Lucky Day: Claim Your Welcome Bonus!

Centra Tech’s Initial CEO

The fictitious CEO of Centra Tech was pronounced dead not long after the company fell apart. CEO Michael Edwards apparently died in a car crash. In fact, Michael Edwards was alive and well and living in Manitoba. His photo was just something that was found on a Google search for “old White guy.”

According to court documents, Sharma and his co-defendants were well aware of the falsity of such claims. For example, with respect to Centra Tech’s purported CEO “Michael Edwards,” Sharma text messaged Trapani and Farkas on or about July 29, 2017, that they “Need to find someone who looks like Michael,” “Team photos,” “He’s real lol,” “Everyone real,” “Except Jessica,” “And Mike.” Similarly, Sharma later wrote during that same exchange: “Gonna kill both Ceo and her,” “Gonna say they were married and got into an accident.”

SEC’s Investigation

By December 2017, Rensel, a project investor filed suit alleging Centra Tech violated securities laws when it raised over $30 million from the Centra Token ICO. The SEC followed with an April 2018 lawsuit arguing much the same. It ordered Centra Tech to cease its ICO and alleged that the project was a multi-million-dollar unregistered securities pumped by celebrity endorsements. The FBI was brought in as rampant fraud was evident at the time.

This would be a high-profile case in the cryptocurrency world. Trapani asked Sharma for $500K to pay off his family’s debt but Sharma refused. Trapani quit Centra Tech, started cashing out millions of dollars, began taking a lot of drugs and gambled. During this time, Trapani’s grandfather died. He was devastated and went on benders—highly addicted to Zanax. While playing a high-stakes poker game, Sharma called him saying he had been arrested by the FBI for securities fraud and wire fraud.

In April 2018, the SEC charged Sharma, Farkas, and Trapani with “orchestrating a fraudulent initial coin offering” and collecting $32 million from it.

The Security and Exchange Commission’s complaint alleged that Sohrab “Sam” Sharma and Robert Farkas, co-founders of Centra Tech. Inc., masterminded a fraudulent ICO in which Centra offered and sold unregistered investments through a “CTR Token.” Sharma and Farkas allegedly claimed that funds raised in the ICO would help build a suite of financial products. They claimed, for example, to offer a debit card backed by Visa and MasterCard that would allow users to instantly convert hard-to-spend cryptocurrencies into U.S. dollars or other legal tender. In reality, the SEC alleged, Centra had no relationships with Visa or MasterCard. The SEC also alleged that to promote the ICO, Sharma and Farkas created fictional executives with impressive biographies, posted false or misleading marketing materials to Centra’s website, and paid celebrities to tout the ICO on social media.

Centra Tech’s Purported Partnerships with Bancorp, Visa, and Mastercard

With respect to Centra Tech’s purported partnerships with Bancorp, Visa, and Mastercard, Sharma engaged in a cellphone text message conversation with Trapani and Farkas on or about July 31, 2017, in which they discussed Centra Tech’s lack of actual partnerships with banks or credit card companies.

Similarly, on or about September 29, 2017, the date on which the United States Securities and Exchange Commission announced that it filed a civil complaint charging a company, among others, with defrauding investors in an unregistered offering of securities styled as an initial coin offering, Sharma asked via a group text message conversation with Trapani and Farkas that they remove certain materials from Centra Tech’s website that contained “fufu,” or fake information, about Centra Tech’s purported relationship with Visa because, according to Sharma, “I rather cut any fufu,” “Off right own,” “Now,” “Then worry,” “Anything that doesn’t exist current,” “We need to remove.”

Later that day, Sharma text messaged Trapani and Farkas: “I want a product page like [another company]. Theirs is so nice.” Trapani wrote “Lol yeah no real product,” to which Sharma responded, “Yea but it doesn’t say much,” “And looks good,” “We don’t have a real product either right now,” “So I wanna tighten up ship asap.”

SEC Halts Centra Tech’s Fraudulent Scheme

SEC Halts Fraudulent Scheme Involving Unregistered ICO (U.S. Securities and Exchange Commission, April 2, 2018)

The Securities and Exchange Commission charged two co-founders of a purported financial services start-up with orchestrating a fraudulent initial coin offering (ICO) that raised more than $32 million from thousands of investors last year. Criminal authorities separately charged and arrested both defendants.

According to the complaint, Farkas made flight reservations to leave the country, but was arrested before he was able to board his flight. Criminal authorities also arrested Sharma.

“We allege that Centra sold investors on the promise of new digital technologies by using a sophisticated marketing campaign to spin a web of lies about their supposed partnerships with legitimate businesses,” said Stephanie Avakian, Co-Director of the SEC’s Division of Enforcement. “As the complaint alleges, these and other claims were simply false.”

“As we allege, the defendants relied heavily on celebrity endorsements and social media to market their scheme,” said Steve Peikin, Co-Director of the SEC’s Division of Enforcement. “Endorsements and glossy marketing materials are no substitute for the SEC’s registration and disclosure requirements as well as diligence by investors.”

The SEC’s complaint charges Sharma and Farkas with violating the anti-fraud and registration provisions of the federal securities laws. The complaint seeks permanent injunctions, return of allegedly ill-gotten gains plus interest and penalties, as well as bars against Sharma and Farkas serving as public company officers or directors and from participating in any offering of digital or other securities.

Founders of Centra Tech Indicted

Founders of Cryptocurrency Company Indicted in Manhattan Federal Court with Scheme to Defraud Investors (U.S. Attorney’s Office, Southern District of New York, May 14, 2018)

Robert Khuzami, Attorney for the United States, announced that a grand jury in the Southern District of New York had returned an Indictment charging SOHRAB SHARMA, a/k/a “Sam Sharma,” RAYMOND TRAPANI, a/k/a “Ray,” and ROBERT FARKAS, a/k/a “RJ,” a/k/a “Bob,” the three co-founders of a start-up company called Centra Tech, Inc., that purported to offer cryptocurrency-related financial products, with conspiring to commit, and the commission of, securities and wire fraud in connection with a scheme to induce victims to invest millions of dollars’ worth of digital funds for the purchase of unregistered securities, in the form of digital currency tokens issued by Centra Tech, through material misrepresentations and omissions.

Charges Against Centra Tech’s Executives

Sohrab “Sam” Sharma

Leading Co-Founder of Cryptocurrency Company Sentenced to 8 Years In Prison for ICO Fraud Scheme (U.S. Attorney’s Office, Southern District of New York, March 4, 2021

Sohrab Sharma was sentenced to 8 years in prison in connection with his leading role in a scheme to induce victims to invest more than $25 million worth of digital funds in Centra Tech, Inc., a Miami-based company he co-founded and that purported to offer cryptocurrency-related financial products.

Sharma previously pled guilty to conspiring to commit securities fraud, wire fraud, and mail fraud in connection with his and his co-conspirators’ use of material misrepresentations and omissions to solicit investors to purchase securities, in the form of digital tokens issued by Centra Tech, through fraudulent fundraising efforts that included an initial coin offering beginning in approximately July 2017.

Mr. Graff reported: “Sohrab Sharma led a scheme to deceive investors by falsely claiming that the start-up he co-founded had developed fully functioning, cutting-edge cryptocurrency-related financial products. In reality, Sharma’s most notable inventions were the fake executives, fake business partnerships, and fake licenses that he and his co-conspirators touted to trick victims into handing over tens of millions of dollars. We will continue to aggressively pursue digital securities frauds like this one.”

In or about October 2017, at the end of the defendants’ fundraising efforts, those digital funds raised from victims were worth more than $25 million. At certain times in 2018, as the defendants’ fraud scheme was ongoing, those funds were worth more than $60 million.

In 2018, this Office and the Federal Bureau of Investigation seized, pursuant to judicially authorized seizure warrants, 100,000 Ether units, consisting of digital funds raised from victims who purchased digital tokens issued by Centra Tech during its fundraising efforts based on fraudulent misrepresentations and omissions. The United States Marshals Service sold the seized Ether units for approximately $33.4 million earlier this year. Following entry of a final order of forfeiture, these funds and other forfeited fraud proceeds will be available for potential use in a remission program that the Department of Justice intends to create to compensate victims of the Centra Tech fraud.

In addition to the prison term, Sharma, 29, of Aventura, Florida, was also sentenced to three years of supervised release and ordered to pay a fine of $20,000. Sharma was further ordered to forfeit $36,088,960.

| $ 2,000.00 |

| Swarovski Soulmates Bull | |

Robert J. Farkas

District Attorney Craig Stewart reported: “Farkas and his co-conspirators duped ICO investors into investing digital currency worth millions of dollars based on fictitious claims about their company, including misrepresentations relating to its purported digital technologies and its relationships with legitimate businesses in the financial services sector. Whether in the context of traditional equity IPOs or newer cryptocurrency-related ICOs, raising capital through lies and deceit is a crime.” Farkas, 33, pled guilty to one count of securities fraud conspiracy and one count of wire fraud conspiracy.” He served one year in prison.

Raymond Trapani

U.S. District Court—Southern District of New York—United States of America v. Raymond Trapani.

Deputy U.S. Attorney Robert Khuzami reported: “As alleged, Raymond Trapani conspired with his co-defendants to lure investors with false claims about their product and about relationships they had with credible financial institutions. While investing in virtual currencies is legal, lying to deceive investors is not.”

Trapani cooperated with the U. S. Government through the whole investigation. His sentence was time served—he was received no jail time due to his cooperation. However, the Judged ordered Trapani to pay $2.9 million to victims.

| $ 280.00 |

| Swarovski Cosmopolitan Watch, Swiss Made, Metal Bracelet, Black, Black Finish | |

Government Recovers Digital Funds Worth More than $60 Million

Following their arrests, the U.S. Attorney’s Office and the Federal Bureau of Investigation (FBI) seized 91,000 Ether units, consisting of digital funds raised from victims as part of the charged scheme. This seized digital currency was worth more than $60 million.

Mr. Khuzami reported: “As alleged, the defendants conspired to capitalize on investor interest in the burgeoning cryptocurrency market. They allegedly made false claims about their product and about relationships they had with credible financial institutions, even creating a fictitious Centra Tech CEO. Whether traditional or cutting-edge, investment vehicles can’t legally be peddled with falsehoods and lies.”

Crypto Scams

Investors in the Centra ICO who believe they may be a victim should contact www.SEC.gov/tcr.

The SEC’s Office of Investor Education and Advocacy issued an Investor Bulletin on initial coin offerings and additional information is available on Investor.gov and SEC.gov.

As time went on, crypto scams became more and more prevalent post-COVID. As of 2022, 78% of crypto business proposals to investors have been scams. Centra Tech was the first to really put all of this under the spotlight. And the owners all fell victim to their own greed.

The Biggest Cryptocurrency Scams in History—CryptoCurrency.org

Crypto Financial Regulators

Securities and Exchange Commission (SEC): The SEC oversees the issuance and sale of securities, including digital assets that meet the definition of securities. This means cryptocurrencies that meet the criteria to be considered securities must be registered with the SEC and comply with its regulations.

Internal Revenue Service (IRS): The IRS treats cryptocurrencies as property for tax purposes, meaning gains and losses from crypto transactions are subject to capital gains taxes.

U. S. Judge: Centra Tech Tokens Were Securities

While crypto-currency-related Centra Tech collapsed, its fraudulent business history is still being reviewed in American courts driven by the lawsuits of angry investors. The enterprise tokens status was clarified by U. S. Magistrate Judge Andrea Simonton (Florida). “Because the success of Centra Tech and the Centra Debit Card, CTR Tokens, and cBay that it purported to develop was entirely dependent on the efforts and actions of the Defendants, the third prong is satisfied. Therefore, the offering of Centra Tokens was an investment contract under the Securities Act, such that the Defendants sold or offered to sell securities by virtue of the Centra Tech ICO.”

Class Action Lawsuit

A suit filed in the U.S. District Court for the Southern District of Florida alleges that Centra’s ICO was an unregistered sale of securities under federal law and seeks to allow what could be thousands of investors to get their money back. It appeared to be the first such federal suit filed against the company since its ICO closed in October.

The complaint argues that Centra has “crafted a flimsy facade” and that the CTR Tokens it issued are not securities but are instead “utility tokens” outside of the purview of the securities laws and the Securities and Exchange Commission.

“In reality, the Centra ICO was obviously an offer and sale of securities,” the complaint argues, pointing to instances where the company’s executives said the value of the digital token would “surge in value” or would yield rewards similar to dividends.

The case was filed by Hollywood, Florida-based Komlossy Law and the firm Levi & Korsinsky. The lawsuit was the latest in a flurry of legal and regulatory action over ICOs, also referred to as digital token offerings.

The class action complaint also alleges that Centra operated a “bounty program” that paid bloggers and others for positive press around the company’s coin offering. To bolster claims that the CTR tokens were securities, the complaint stressed that their value depended entirely on the efforts of the company, and that Centra acknowledged as much in an earlier version its “white paper.” The complaint cited an excerpt of the paper that said that the tokens “could become useless and/or valueless due to technical, commercial, or regulatory challenges, among other reasons.”

Jacob Zowie Thomas Rensel and others, Plaintiffs, v. Centra Tech, Inc., Defendant

Using Bitcoin Cryptocurrency

The easiest way to buy anything with Bitcoin is with a crypto debit card. Crypto debit cards partner with payment-processing giants like MasterCard and Visa to ensure transactions occur seemlessly.

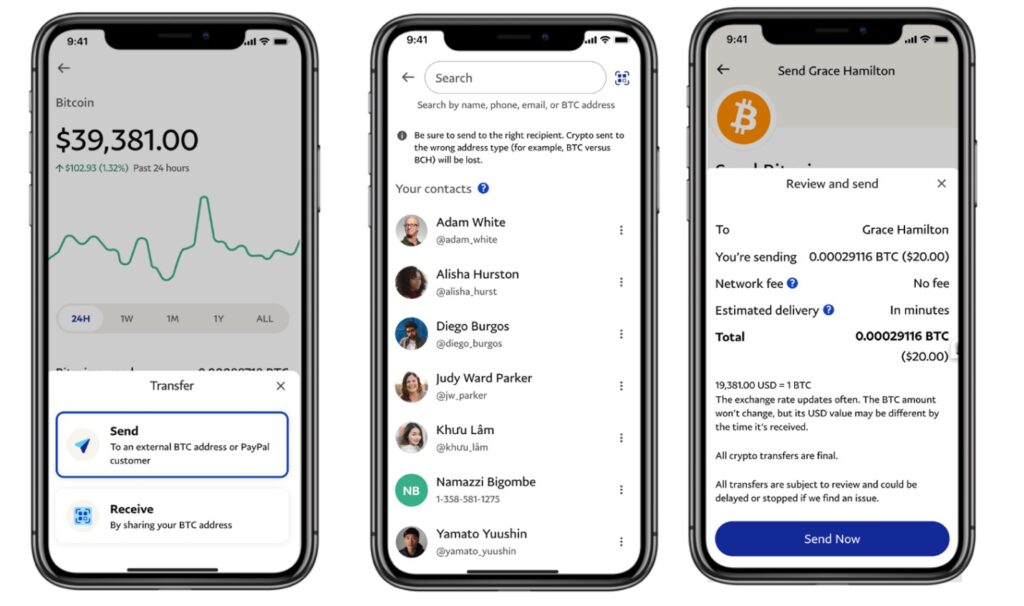

Buy, Sell & Hold Cryptocurrency with PayPal

PayPal also allows customers to buy, sell, and hold cryptocurrency in their accounts. NOTE: PayPal’s crypto services are not available in Hawaii. PayPal has also been granted a full Bitlicense by the New York Department of Financial Services

PayPal supports the native transfer of cryptocurrencies between PayPal and other wallets and exchanges. Allowing PayPal Users the flexibility to move their crypto assets (Bitcoin, Ethereum, Bitcoin Cash, or Litecoin) into, outside of, and within our PayPal platform reflects the continuing evolution of our best-in-class platform and enables customers to interact with the broader crypto ecosystem. Customers who transfer their crypto into PayPal can extend the utility of their crypto by spending using our Checkout with Crypto product at millions of merchants.

Sending and Receiving Crypto with PayPal

Send crypto to associates, charitable donations, family, and friends on PayPal in seconds. Once logged into PayPal, enter the crypto section of your application and choose the currency you want to send. Click or tap the transfers button and select “Send”.

Select the PayPal contact to which you’d like to send to crypto and confirm your fee-free transfer.

As of May 6, 2024, the value of 0.5 Bitcoin was $31,987 USD, 1 Bitcoin was $63,974 USD, and 5 Bitcoins was $319,872 USD. (Source: Coinbase)

Related Information on Bitcoin Cryptocurrency

Interesting Books on Bitcoin and Cryptocurrencies—Available on Amazon

Cryptocurrencies for Beginners: Protecting Your Crypto Investments, Detecting and Evading Crypto Scams by Crypto Guardian

This essential guidebook is designed for the modern investor seeking to navigate the booming world of cryptocurrencies with an eye for unmatched wealth generation and a shield against the predators lurking in the shadows.

Bitcoin and Cryptocurrency Technologies: A Comprehensive Introduction

How do Bitcoin and its block chain actually work? How secure are your bitcoins? Whether you are a student, software developer, tech entrepreneur, or researcher in computer science, this authoritative and self-contained book tells you everything you need to know about the new global money for the Internet age.

The Basics of Bitcoins and Blockchains: An Introduction to Cryptocurrencies and the Technology That Powers Them—Audible Audiobook

Crypto in 4 Hours: How Digital Currency Can Safeguard Your Wallet in Uncertain Times

All you need to know about Crypto Wallets and Exchanges: choosing them, leveraging them, and making them work for you. The Pros and Cons of Investing in Cryptocurrencies – because every coin has two sides.

Bitcoin and Cryptocurrency Trading for Beginners

To become a crypto trader, you need to be well equipped with a wealth of information not to get stocked along the line. In recent time, cryptocurrency trading has created wealth and still have more opened opportunities for newbies who want to trade and make money online.

Mastering Bitcoin: Programming the Open Blockchain

A deep dive into Bitcoin applications, including how to combine the building blocks offered by this platform into powerful new tools.Ideal for nontechnical users, investors, and business executives

Mastering Crypto Assets: Investing in Bitcoin, Ethereum and Beyond

A team of seasoned investors and digital asset strategists presents a comprehensive guide aimed at professional investors for integrating crypto assets into traditional portfolios. The book also delves into the unique risk and return characteristics of various digital asset sectors.

The Genesis Book: The Story of the People and Projects That Inspired Bitcoin by Aaron van Wirdum

Bitcoin did not appear out of nowhere. For decades prior to Satoshi Nakamoto’s invention, a diverse group of computer scientists, privacy activists, and economists tried to create a digital form of money that could operate independently of government control.

| $ 434.00 |

| Lenovo TIO27 – 27inch Monitor | |

Apple iPad Air 10.9” Display, 256GB, Supercharged by the Apple M1 Chip, Touch ID. The iPad Air is a creative powerhouse. Wi-Fi 6 gives you fast access for uploads and downloads. All-Day Battery Life.

Amazon Kindle Paperwhite eBook Reader (16 GB). Now with a 6.8” display and thinner borders, adjustable warm light, up to 10 weeks of battery life, and 20% faster page turns. Purpose-built for reading – With a flush-front design and 300 ppi glare-free display that reads like real paper, even in bright sunlight. Waterproof reading – Built to withstand accidental immersion in water, so you’re good from the beach to the bath.

How Centra Tech’s Bitcoin Scheme Was Discovered

- Moving and Relocating to Atlanta: How to Find Your New Home

- Money Matters: Insider Tips to Buying a Home

- Renting vs Owning a Home

- 3 Powerful Benefits of Using Managed WordPress Web Hosting

- Ways to Build Positive Credit

- Do It Yourself Credit Improvement Process

- Guides to Backpacking, Mountain Biking and Hiking Georgia

- How to Create an Ergonomic Workspace at Home or Work

- Backpacking, Hiking, and Camping Safety Guides

- A Trail of Clues to the Murder of Nicole Brown Simpson

- How Centra Tech’s Bitcoin Cryptocurrency Scheme Was Hatched and Discovered

- Starting a New Business as a New Mother: Tips for Thriving

- Balancing Success: Practical Self-Care Strategies for Entrepreneurs

- Guides to Backpacking and Hiking the Carolinas

- Guides to Hiking New York State and New Jersey

- Guides to Backpacking and Hiking Canada

- Guides to Hiking California and Nevada

- Email Marketing Campaigns for Small Business Owners

- The Tragic Murder of Rebecca Postle Bliefnick

- How a Grad Student Murder Spotlights Female Joggers’ Safety Concerns