Your Credit Report History Matters as Much as Your Credit Score. Mistakes in Your Reports Could Hurt Your History and Scores.

Credit card companies, banks, mortgage companies, auto loans, insurance companies, landlords, and employers use credit reports to check your credit history before deciding on doing business with you.

They know that if you were responsible in the past, you are likely to be accountable in the future.

Where Do Credit Scores Come From?

Your Credit Scores are Generally Based on Information in Your Credit Reports.

Many Scores Range From 300 to 850, But Different Companies Use Different Ranges.

This Information is Reported By Your Lenders To Credit Reporting Agencies.

The Three Biggest Credit Bureaus are Equifax, Experian, and TransUnion.

Why Are There Different Credit Scores?

You Can Have More Than One Credit Score Because:

Lenders Use Different Scores For Different Products

There Are Different Credit Scoring Formulas

Information Can Come From Different Credit Reporting Sources

For Example, a Credit Card Score could be Different from an Auto Loan Score or Home Loan Score.

For some people, these differences are not that big.

But, because lenders use different scores, you might qualify for lower rates with one lender and not another.

Why You Should Strive for a Higher Credit Score

The higher your score is, the more likely you are to get a loan.

If you have a low score and manage to get approved for credit, then your interest rate will be much higher than someone with good credit.

Your monthly loan and credit card payments can easily be 40% higher with a low score.

A higher credit score can save you an enormous amount of money over the life of your mortgage, auto loan, or credit card.

A Higher Credit Score Makes It Easier to Qualify for a Loan and Lower Interest Rates.

Banks, Credit Card Companies, and Other Businesses Use Credit Scores to Estimate How Likely You Are to Pay Back Money You Borrow.

How Your FICO Score Affects Your Interest Rate

FICO stands for Fair, Isaac & Co. They’re the ones who created the mathematical formula used to calculate what is commonly called the FICO score.

FICO helps banks, credit card issuers, auto loan companies, and other lenders decide if you are a credit risk.

Thus, a credit score of 720 or higher is the magic number to strive for.

Variables That Affect Your Credit Score

How Many Credit Accounts You Have

How Long You Have Had Those Accounts

How Close You Are To Your Credit Limit

How Often Your Payments Have Been Late

Other Factors

How Your Credit Score Affects the Cost of Purchasing a Car

Here is an Eye-Opening Example:

Roy and Regina have two different credit scores, and they both want to purchase a brand new Toyota Camry for $23,000 for a 66-Month Term.

Here’s what it will cost each of them:

| ROY | REGINA |

| Credit Score: 730 | Credit Score: 599 |

| Interest Rate: 1.99% | Interest Rate: 14.99% |

| Monthly Payment: $368.22 | Monthly Payment: $513.97 |

| Total Interest Paid: $1,302.39 | Total Interest Paid: $10,921.44 |

| Total Payments: $24,302.39 | Total Payments: $33,921.44 |

Note that Regina pays $9,616.05 MORE than Roy for the same car and price.

This same thing happens with your credit cards, mortgage, and other loans.

Swiftly improving your credit will lower your bills and can save you hundreds of thousands of dollars.

Tips on How To Boost Your Credit Score

A Long Credit History Helps Your Score. Credit scores are based on experience over time. Your score improves the longer you have credit, open different types of accounts, and pay back what you owe on time.

Paying Your Bills On Time

The most significant impact on your credit score is paying your bills on time. One way to make sure your payments are on time is to set up automatic payments or set up electronic reminders. If you have missed payments, get current and stay current.

Be Careful Closing Accounts

If you close some credit card accounts and put most or all of your credit card balances onto one card, it may hurt your credit score if you are using a high percentage of your total credit limit. Frequently opening accounts and transferring balances can hurt your score too.

Do Not Get Close to Your Credit Limit

Credit scoring models look at how close you are to being “maxed out.”

Try to keep your balances low in proportion to your overall credit limit.

Experts advise keeping your use of credit at no more than 30% of your total credit limit.

Only Apply For Credit You Need

Credit scores look at your recent credit activity as an indicator of your need for credit.

If you apply for a lot of credit over a short period, it may appear that your money situation has changed for the worse.

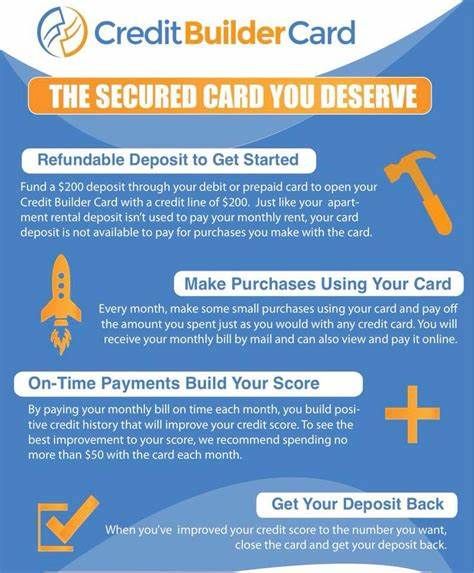

Need to Re-Build Your Credit or Establish New Credit in your name. Start with a Secured Credit Card with a $200.00 deposit. No Credit Score Requirement. Easy application process. Click Here to Apply. Note: Must have no active bankruptcy. Make your monthly payments on time each month, and you will build a positive credit history.

Review Your Credit Reports Pronto

When you get your reports from the three credit bureaus, look for:

Mistakes in Your Name, Phone Number, and Address.

Loans, Credit Cards, or Other Accounts That Are Not Yours

Reports That You Paid Late When You Paid On Time

Accounts You Closed That Are Listed As Open

The Same Item Showing Up More Than Once (Like an Unpaid Debt)

How to Fix Credit Report Errors and Negative Information

If you find something wrong in your credit report, you should contact the credit bureau(s). Explain what you think is wrong and why. Include copies of documents that support your dispute.

Don’t Have Perfect Credit?

No worries! You can have damaging misinformation removed from your reports, lower your payments, and raise your credit score higher to get the loan that you want at the low-interest rates you deserve.

All it takes is perseverance, a positive attitude, and knowledge.

Do It Yourself Credit Improvement Process

Correcting mistakes on a credit report to improve an undesirable credit score takes time, and it’s your responsibility to correct errors that may appear on your accounts.

To do this, you must regularly review your credit reports.

More Credit Resources

Money Matters: Insider Tips to Buying a Home

Things You Need to Know About Credit—Consumer Financial Protection Bureau

How to Improve Your Credit History and Scores

- Moving and Relocating to Atlanta: How to Find Your New Home

- Money Matters: Insider Tips to Buying a Home

- Renting vs Owning a Home

- 3 Powerful Benefits of Using Managed WordPress Web Hosting

- Ways to Build Positive Credit

- Do It Yourself Credit Improvement Process

- Guides to Backpacking, Mountain Biking and Hiking Georgia

- How to Create an Ergonomic Workspace at Home or Work

- Backpacking, Hiking, and Camping Safety Guides

- A Trail of Clues to the Murder of Nicole Brown Simpson

- How Centra Tech’s Bitcoin Cryptocurrency Scheme Was Hatched and Discovered

- Starting a New Business as a New Mother: Tips for Thriving

- Balancing Success: Practical Self-Care Strategies for Entrepreneurs

- Guides to Backpacking and Hiking the Carolinas

- Guides to Hiking New York State and New Jersey

- Guides to Backpacking and Hiking Canada

- Guides to Hiking California and Nevada

- Email Marketing Campaigns for Small Business Owners

- The Tragic Murder of Rebecca Postle Bliefnick

- How a Grad Student Murder Spotlights Female Joggers’ Safety Concerns

- How Massive Commercial Financial Fraud Was Discovered in Singapore

- Guide to Martha Stewart’s Hugely Successful Concept and Art of Presentation

- Did Billy Ray Turner Conspire with Sherra Wright to Kill Former NBA Player Lorenzen Wright?

- How Operation Rebound’s 7-Year Cold Case was Finally Solved

- Stylish Outdoor Fire Pits and Patio Heaters

- Mastering DIY Marketing: Essential Skills and Strategies for Small Business Owners

- Great Deals on Snug UGG All-Season Boots

- How a GeoLocation Expert Tracked a Killer

- Transgender Law Enforcement Officer Denied Medical Coverage for Gender Dysphoria

- How Video Surveillance Cameras Helped Identify and Track a Killer

- How Investigators Solved the Murder Mystery of Army Sergeant Tyrone Hassel III

- How a Love Obsession Led to the Brutal Murder of Anna Lisa Raymundo

- How Stephen Grant Tried to Get Away with Killing His Wife

- How Unrelenting Catfish Schemes Led to Fatal Suicide

- How Pain Clinic Owners Turned Patients’ Pain into Enormous Profits

- How to Recognize a Pain Pill Mill in Your Community

- How Authorities Have Shuttered Georgia Pain Clinics Massive Pain Pill Distributions

- How Pain Doctors Massive Opioid Prescriptions Lead to Pain Pill Overdose Deaths

- How Authorities Are Dismantling Pennsylvania Pain Clinics Prescribing Excessive Amounts of Opioid Pain Pills

- How Authorities Are Dismantling Alabama Pain Clinics Pain Pill Schemes

- How the Gilgo Beach Homicide Investigation Has Progressed

- How NYC Architect was Linked to Three Women’s Remains Found on Gilgo Beach

- How Investigators Discovered a Serial Killer Hiding in Plain Sight

- How Police Discovered the Concealed Murders of the Chen Family

- How a Vicious Child Custody Battle Led to the Murder of Christine Belford

- How Authorities Finally Captured a Serial Killer in Southern Louisiana

- How Authorities Are Busting Pill Mills in The Carolinas

- Unsolved Mystery: Triple Murder at the Blue Ridge Savings Bank

- How Montgomery County Police Quickly Unraveled the Murder of a Retail Store Employee in Bethesda

- How a Child Rapist and Murderer Almost Got Away with His Crimes in England

- How Authorities Are Dismantling Pill Mills in the United States

- How Federal Agencies Are Dismantling Michigan Pain Clinic Doctors Scheme to Distribute Enormous Amounts of Opioid Pain Pills

- How Authorities Are Cracking Down on Virginia Pain Clinics Massive Pain Pill Operations

- How Authorities Are Honing in on Kentucky Pain Clinics Distributing Opioid Painkiller Pills for Profit

- How Federal Agencies Are Shutting Down Maryland Pain Clinics Operating as Pill Mills

- How Federal Agencies Are Dismantling New York Pain Clinics Vast Pain Pill Operations

- How the Senseless Murder of Tequila Suter Was Quickly Solved

- How Authorities Are Dismantling Ohio Pain Clinics Prescribing Excessive Pain Pills

- How Authorities are Dismantling Tennessee Pain Clinics Prescribing Massive Quantities of Opioid Pain Pills

- How State and Federal Agencies Are Shuttering California Pain Clinics Huge Distribution of Opioid Pain Pills